A mostly Republican Congress is about to reform taxes and tax reform is a big part of Trump's plans for America. It's why the stock market is so high in the US at the moment because business feels that Republicans will be kind to them.

Republican talking heads are showing up on the news shows telling us how American business will leave the US because of high taxes.

https://www.bloomberg.com/news/artic...es-aren-t-high

Americans generally feel they’re being over-taxed, especially around this time of the year. Even their president agrees:

“With lower taxes on America’s middle class and businesses, we will see a new surge of economic growth and development,” Donald Trump said this month, expanding on an earlier promise to cut Uncle Sam’s bill “massively.” But the reality is that the average U.S. worker pays quite a bit less than he would elsewhere in the developed world. And what’s more, this has been the case for a long time.

Your cheat sheet on life, in one weekly email.

Get our weekly Game Plan newsletter.

Enter your email

Sign Up

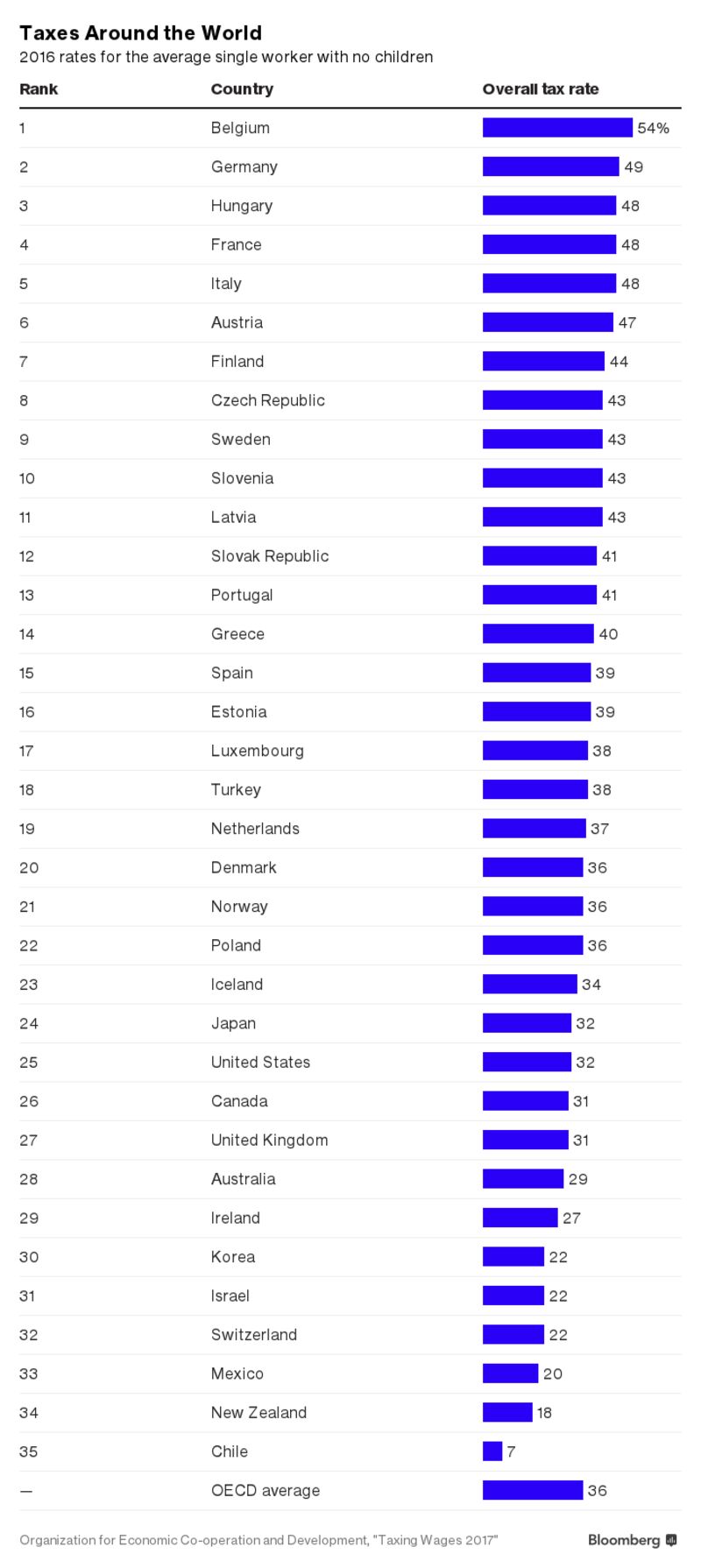

The Organization for Economic Cooperation and Development analyzed how 35 countries tax wage-earners, making it possible to compare tax burdens across the world’s biggest economies. Each year, the OECD measures what it calls the “tax wedge,” the gap between what a worker gets paid and what they actually spend or save. Included are income taxes, payroll taxes, and any tax credits or rebates that supplement worker income. Excluded are the countless other ways that governments levy taxes, such as sales and value-added taxes, property taxes, and taxes on investment income and gains.

Guess who came out at the top of the list? No. Not the U.S. At the top are Belgium and France, while workers in Chile and New Zealand are taxed the least. America is in the bottom third.

A single worker earning an average wage in Belgium ends up paying a tax rate almost eight times higher than the average single worker in Chile, the OECD found.

But one simple number can be deceiving if you’re trying to paint a national picture. Married people and those with children tend to pay different tax rates than single, childless taxpayers. And in most countries, including the U.S., the well-off pay far more than lower-income people.

When the OECD analyzed married couples with children, the rankings looked a little different. New Zealand ends up with the lowest rate, while France ranks number one.

But let’s get back to America. The average single U.S. worker with no kids earned $52,543 last year and paid a combined $13,649 in payroll taxes, federal income tax, state and local government taxes 1 . Their employer pitched in another $4,020 in payroll taxes. That overall rate, of 31.7 percent, might seem like a lot, but it’s more than 4 points below the OECD average.

In every other scenario analyzed by the OECD in its 584-page “Taxing Wages” report, the U.S. tax burden was also below average, from 3 points to almost 6 points depending on the taxpayers’ wages, marital status, and number of children. In fact, the tax burden on most American workers hasn’t budged much over the last two decades, despite tax cuts under former President George W. Bush and upper-income tax hikes under former President Barack Obama.

Workers in two of the world’s highest-taxed countries did get some relief last year. The average tax burden for singles fell by 2.5 percentage points in Austria and by 1.3 points in Belgium from 2015 to 2016. Otherwise, the OECD data suggest that a country’s tax burden usually stays remarkably consistent from year to year and decade to decade.

The only reliable way to change your tax burden may be to move.

-

2017-04-12, 10:13 AM #1

Sorry America, Your Taxes Aren’t High

.

"This will be a fight against overwhelming odds from which survival cannot be expected. We will do what damage we can."

-- Capt. Copeland

-

2017-04-12, 10:30 AM #2The Unstoppable Force

- Join Date

- Mar 2012

- Posts

- 23,787

The US had much higher tax on corporations and the economy was doing fine. Then Reagan came along and gave massive tax breaks to the wealthy and raised taxes for the middle class.

The US has never recovered from this and the middle class has been stagnating ever since.

-

2017-04-12, 10:50 AM #3Rudimentary creatures of blood and flesh. You touch my mind, fumbling in ignorance, incapable of understanding.

You exist because we allow it, and you will end because we demand it.

Sovereign

Mass Effect

-

2017-04-12, 10:55 AM #4The Unstoppable Force

- Join Date

- Mar 2012

- Posts

- 23,787

-

2017-04-12, 11:11 AM #5

-

2017-04-12, 11:13 AM #6Dreadlord

- Join Date

- Oct 2009

- Posts

- 988

So you are saying the US is overreacting?

-

2017-04-12, 11:13 AM #7

Also we have the third highest business tax rate in the world, which is why a lot of R&D has been moving to Canada.

-

2017-04-12, 11:15 AM #8Grunt

- Join Date

- Aug 2009

- Posts

- 15

If you're talking about corporate taxes, why post a list of what countries pay in personal income tax?

Also, what do citizens in other countries get out of their taxes? I'd venture that Americans with a job that make enough not to get the EITC get less in government services than most other countries do.

-

2017-04-12, 11:16 AM #9Deleted

Got to love my homecountry...54%.

-

2017-04-12, 11:18 AM #10Legendary!

- Join Date

- Jun 2014

- Posts

- 6,211

That's straight taxes, tack on every single fee, registration, etc. that is required and it goes much higher. Compound this if you own a business of any kind, from a large one to literally just yourself. There's absolutely no way 2/3rds of peoples' income is free and clear theirs to do things with.

Regardless the extent isn't a comparison to the rest of the world, each country is free to create the system and therefore the tax requirements that they choose. Germany especially doesn't have any room to complain since it reaps the rewards of the entire Euro economic platform almost to the extent of a shady fraud.The Fresh Prince of Baudelaire

Banned at least 10 times. Don't give a fuck, going to keep saying what I want how I want to.

Eat meat. Drink water. Do cardio and burpees. The good life.

-

2017-04-12, 11:50 AM #11

-

2017-04-12, 12:02 PM #12Legendary!

- Join Date

- Jun 2014

- Posts

- 6,211

Again, I'm not comparing or contrasting. I'm basically lump summing my argument. The argument that a third of peoples' earnings to taxes isn't high is fucking ridiculous. That it necessitates advancing the idea that anything higher than that is even moreso is obvious but again, Europe is free to make whatever system they like and for the most part they have, so their complaints should be completely internal.

My 2nd point is an associative one. It's easy to both complain about higher taxes and also pay them when you've got a litany of sweetheart deals and provisions baked into EU economic policy.The Fresh Prince of Baudelaire

Banned at least 10 times. Don't give a fuck, going to keep saying what I want how I want to.

Eat meat. Drink water. Do cardio and burpees. The good life.

-

2017-04-12, 12:04 PM #13

-

2017-04-12, 12:15 PM #14

The alt-right utterly fails to understand that low taxes means nothing if it means your living expenses are through the roof.

"Yeah you have to pay through your nose for healthcare, necessities, housing, transport, etc, but all that doesn't matter as long as you have a low tax rate." - Republicans 2017"My successes are my own, but my failures are due to extremist leftist liberals" - Party of Personal Responsibility

Prediction for the future

-

2017-04-12, 12:27 PM #15Legendary!

- Join Date

- Jun 2014

- Posts

- 6,211

The Fresh Prince of Baudelaire

Banned at least 10 times. Don't give a fuck, going to keep saying what I want how I want to.

Eat meat. Drink water. Do cardio and burpees. The good life.

-

2017-04-12, 12:29 PM #16

-

2017-04-12, 12:31 PM #17Legendary!

- Join Date

- Jun 2014

- Posts

- 6,211

-

2017-04-12, 12:32 PM #18

Your chart is comparing personal taxes. I always thought the argument was that business tax was too high. Plus I don't see the US companies moving jobs to Belgium or France. A lot of outsourcing is going to Mexico, India, and China. At least that is what is happening in the industry I work in.

-

2017-04-12, 12:33 PM #19

-

2017-04-12, 12:35 PM #20

Take a look at the US corporate tax rate and you'll see what people are talking about when they discuss the US's taxes being too high.

Personally, I do think income taxes are too high. I'm a proponent of a percentage-based tax code instead... with everybody paying a fixed percentage of their income, like 15%. You'd see explosive growth.

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

Dragonflight Season 4 Goes Live This Week

Dragonflight Season 4 Goes Live This Week MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote