-

2017-04-12, 07:10 PM #181The Lightbringer

- Join Date

- Oct 2010

- Posts

- 3,115

-

2017-04-12, 07:10 PM #182Scarab Lord

- Join Date

- Dec 2009

- Location

- Toronto, Ontario

- Posts

- 4,664

(This signature was removed for violation of the Avatar & Signature Guidelines)

-

2017-04-12, 07:11 PM #183Stood in the Fire

- Join Date

- Aug 2011

- Posts

- 395

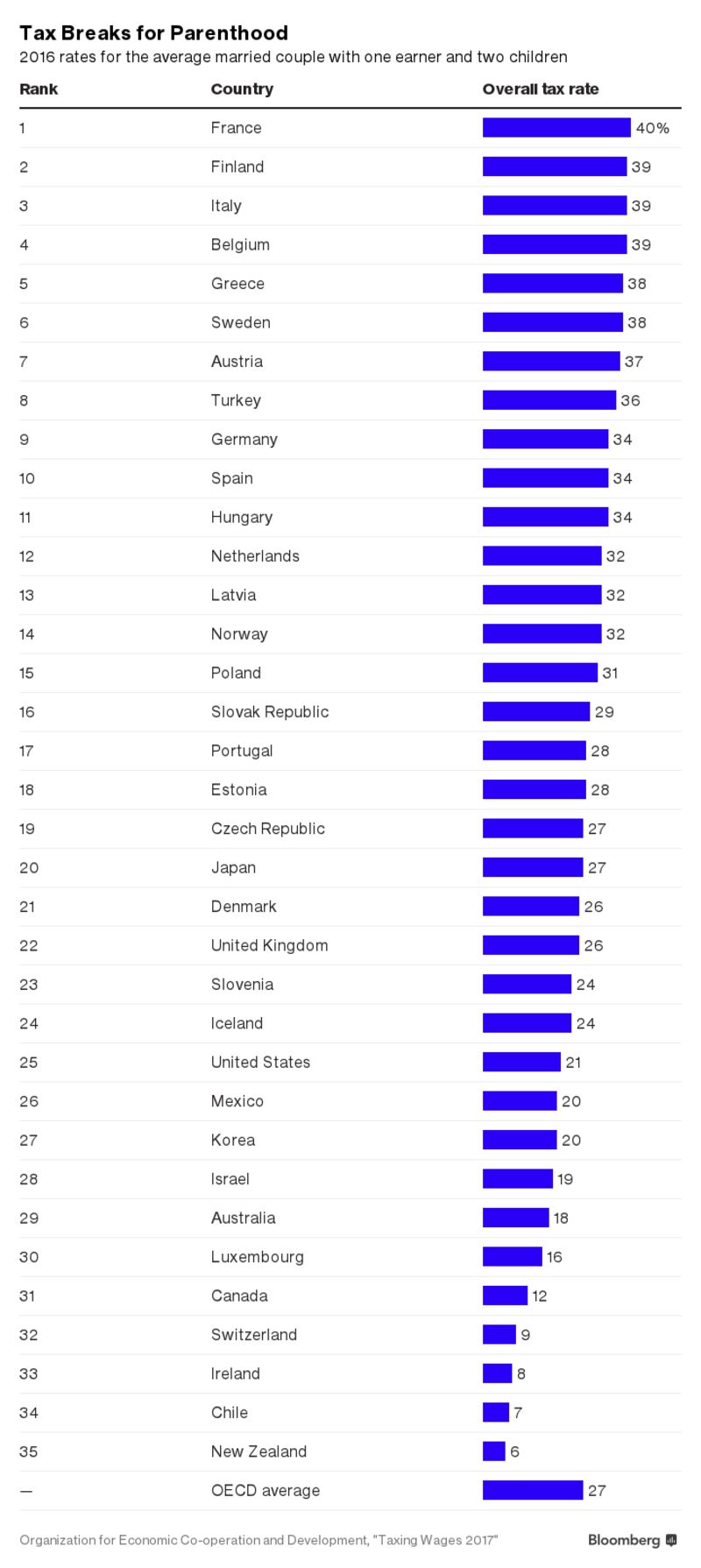

Just to all who say that in the US you do pay a lot of taxes:

US Tax freedom day 2015 :24 april

Belgium tax freedom day 2015 :6 August

-

2017-04-12, 07:11 PM #184

1) I agree they should just lower it but the loopholes exist to make exemptions for the rich and corporations, they should lower it and get rid of loopholes.

2) I thought conservatives were against government picking winners and losers and wanting the free market to decide. Those companies are already paying very little to no taxes I rather find another solution around the problem.

As for China it is not our place to tell China what to do, trade policies in the past were awful and have been costly but that is not the current state of China. Their internal policies are not that much worse than that of our other trading partners or our own subsidies and patent policies that have resulted in monopolies. The american system has screwed the average american not the Chinese. You are like someone complaining about a small leak on a boat not realizing that you are on the titanic and it has a gaping hole in it.

-

2017-04-12, 07:12 PM #185

-

2017-04-12, 07:14 PM #186Scarab Lord

- Join Date

- Dec 2009

- Location

- Toronto, Ontario

- Posts

- 4,664

(This signature was removed for violation of the Avatar & Signature Guidelines)

-

2017-04-12, 07:17 PM #187

Remember that Canada has provincial taxes that can hit harder on families, among other things. And on top of that, the sales tax here in Québec is double that of the Federal's. Federal taxation isn't the only one, and I'm sure other countries are in a similar position. Whereas I believe France has the vast majority of its taxation done by the State, for instance.

-

2017-04-12, 07:19 PM #188Scarab Lord

- Join Date

- Dec 2009

- Location

- Toronto, Ontario

- Posts

- 4,664

(This signature was removed for violation of the Avatar & Signature Guidelines)

-

2017-04-12, 07:31 PM #189Mechagnome

- Join Date

- Aug 2012

- Posts

- 709

The individual tax rates aren't what concern me. Business will leave because our business tax rate is the 10th highest in the world. The only countries that are higher than us, in ascending order:

Pakistan (35%)

Gabon (35%)

Burundi (35%)

Benin (35%)

Bangladesh (35%)

Argentina (35%)

Angola (35%)

Camaroon (38.5%)

Greece (58%)

Note: None of these countries have State or Local business taxes, so the USA business tax rate of 35% is actually 35%-47% depending on where you live. Nobody is saying that businesses are leaving because of individual income taxes; that's just fucking retarded.

Note #2: I would also love to hear some feedback about the economic state of literally every country on this list, and try to tell me that they have booming economies.CPU: Intel i7 3770K Mobo: Asus P8Z77-V PRO GPU: 2X Asus GTX 770 OC SLI Heatsink: Hyper 212 EVO RAM: Corsair Vengeance 2x8GB 1600mhz SSD: 120Gb Samsung 840 EVO HDD: WD 2tb Caviar Black PSU: Corsair HX850 Case: CM HAF 932 Advanced

-

2017-04-12, 07:32 PM #190

Looking at the link, it does look like they take this into account, but do not count sales taxes and such. But I know a couple in Canada definitely pays more than 12% of their income in taxes, total, so I'm not certain how they arrived to these results.

Also, @ Tijuana, what's with your obsession with the Queen? She's little more than a celebrity nowadays, a nominal Head of State that doesn't do jack and has about as much influence in my life as Meryl Streep has in yours. And yes, her official designation here is Queen of Canada. In New Zealand she's the Queen of New Zealand, so on and so forth. She has so little actual power that she might as well call herself the Queen of Mars and it wouldn't affect shit anyways.

-

2017-04-12, 07:34 PM #191

-

2017-04-12, 07:35 PM #192

-

2017-04-12, 07:35 PM #193Mechagnome

- Join Date

- Sep 2012

- Posts

- 604

-

2017-04-12, 07:37 PM #194The Unstoppable Force

- Join Date

- Mar 2012

- Posts

- 23,787

-

2017-04-12, 07:38 PM #195Scarab Lord

- Join Date

- Dec 2009

- Location

- Toronto, Ontario

- Posts

- 4,664

Culture and history.

Because she's not foreign and the monarch played an important part of Canadian historyHow is it not embarrassing to you, to have a foreign queen on your money?

Only idiots see Canada, or any country that still has the Queen as their head of state, as a puppet state.Does it not bother you at all, that the rest of the world sees you as a puppet state?

- - - Updated - - -

I don't know about their household income tax chart, but the individual tax chart is pretty spot on for me at least. I don't think household income taxes are different from individual taxes on your actual paycheque but you do get deductions at the end of the year which is probably what they are taking into account to arrive at that 12%.(This signature was removed for violation of the Avatar & Signature Guidelines)

-

2017-04-12, 07:43 PM #196

-

2017-04-12, 07:44 PM #197Scarab Lord

- Join Date

- Dec 2009

- Location

- Toronto, Ontario

- Posts

- 4,664

(This signature was removed for violation of the Avatar & Signature Guidelines)

-

2017-04-12, 07:44 PM #198Mechagnome

- Join Date

- Aug 2012

- Posts

- 709

The corporate tax rate on my company is indeed 35%, + 6.35% state income tax, 13.4% Federal Payroll Tax, 9.3% Social Security Tax, 2.1% Medicare Tax, 2% State Payroll Tax, and 1.5% Local Payroll Tax, for a grand total of 69.65%. After all deductions, depreciation, reinvestment, and pre-tax investment, we pay about 40%. This is still among the highest in the world.

CPU: Intel i7 3770K Mobo: Asus P8Z77-V PRO GPU: 2X Asus GTX 770 OC SLI Heatsink: Hyper 212 EVO RAM: Corsair Vengeance 2x8GB 1600mhz SSD: 120Gb Samsung 840 EVO HDD: WD 2tb Caviar Black PSU: Corsair HX850 Case: CM HAF 932 Advanced

-

2017-04-12, 07:45 PM #199The Unstoppable Force

- Join Date

- Mar 2012

- Posts

- 23,787

-

2017-04-12, 07:47 PM #200Scarab Lord

- Join Date

- Dec 2009

- Location

- Toronto, Ontario

- Posts

- 4,664

(This signature was removed for violation of the Avatar & Signature Guidelines)

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

Filter options for non retail wow content

Filter options for non retail wow content The War Within Alpha - Warbands Feature Overview

The War Within Alpha - Warbands Feature Overview Are we approaching a Solo Raid WoW Experience?

Are we approaching a Solo Raid WoW Experience? MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote