View Poll Results: What's your FICO Score?

- Voters

- 54. This poll is closed

-

2017-07-19, 06:42 PM #21

-

2017-07-19, 06:43 PM #22

-

2017-07-19, 06:45 PM #23Brewmaster

- Join Date

- Jun 2009

- Posts

- 1,373

-

2017-07-19, 06:48 PM #24Brewmaster

- Join Date

- Jun 2009

- Posts

- 1,373

-

2017-07-19, 06:52 PM #25

-

2017-07-19, 07:02 PM #26

Because you just made 100 bucks.

Before the housing fallout several years back, you were seeing interest rates for some savings accounts hitting 5% or so. People who had extremely good credit (and usually owned a home) would practice credit card arbitage, which would mean they'd leverage as much credit as possible on 0% credit cards (typically balance xfer), throw all that money into a 5% account, wait almost the entire alloted time, then just pull out what they needed to pay off the cards.

If an emergency comes up before the 0% is due, you just pay if off early. This doesn't sound like a ton of money, but 5% guaranteed on 100k or so becomes rather worthwhile.

You don't see it happening now, because interest rates make saving money generally pointless.

More reading: https://www.thepennyhoarder.com/smar...ard-arbitrage/

-

2017-07-19, 07:06 PM #27

Check back in June. Only been building credit for five years.

-

2017-07-19, 07:16 PM #28

-

2017-07-19, 07:18 PM #29Immortal

- Join Date

- Aug 2010

- Posts

- 7,489

-

2017-07-19, 07:20 PM #30

-

2017-07-19, 07:21 PM #31

Milli Vanilli, Bigger than Elvis

Milli Vanilli, Bigger than Elvis

-

2017-07-19, 07:24 PM #32

One of the easiest ways to build credit it to get a credit card (or two) and use them to pay off the entirety of your bills, then immediately go and pay off the credit cards with your bank balance. If you do it quick you don't accrue interest, and it looks great on your credit history (putting a large balance on it every month, and then paying it off in full)

-

2017-07-19, 07:24 PM #33

-

2017-07-19, 07:24 PM #34

I wonder about that...

Credit scores are a double edged sword. I tend to view them as how much am I being suckered into borrowing money at such interest rates.

That being said , if a person wants a high interest score just make sure you pay at the very least the monthly minimum ON TIME.

I just as soon pay cash or do without. (Not realistic, I know)

-

2017-07-19, 07:25 PM #35

-

2017-07-19, 07:28 PM #36

-

2017-07-19, 07:31 PM #37

-

2017-07-19, 07:33 PM #38

-

2017-07-19, 07:37 PM #39The Patient

- Join Date

- Nov 2016

- Posts

- 286

670.

Kinda sucks but that was up from about 620 a couple of years ago. I was in a very bad place financially, underemployed with a family and I needed to put budget overruns on my credit balance.

My tips for rasing your score:

Use credit cards for all necessities where you can to build credit and get cash back. Use cash back directly on your balance.

Put your cards on auto pay for the minimum. That way if you forget to make a payment you'll be covered.

Limit your spending as much as possible and put as much down on your debt as you can every paycheck (make sure you set aside enough for rent and utilities)

Keep a running ledger of expenses so you can see where cash is going at any given point.

After you get 2-3 good cards don't apply for anymore. The credit checks generally aren't worth it.

Every 6 months or so try for a credit line increase, BUT only if your card provider dose soft credit checks. If you need to authorize a credit check, don't do it, its usually not worth the hit unless you are VERY confident your Credit Line will increase.

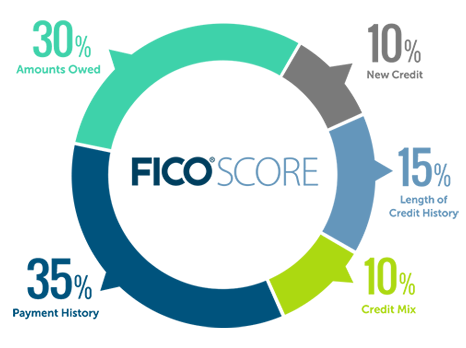

Don't close credit accounts unless you absolutely have too. FICO takes into account length of credit history and if you shut an old one down that's a lot of history you're wiping.

Take every opportunity you can to make money, and put it down on your debt. Its hard to work and not treat yourself, but its better in the long run.

If your in a bind you can try to play the "closing dates" on your cards. The closing date is the only date where the balance on a card counts toward your credit score. Its usually 1-3 business days after your due date (check your individual statements and cardholder agreements) So if you need to carry a balance try to make big payments before the closing date, and then just build up the rest of the month again. You're credit will look much better even if there is no practical change in your financial situation.

-

2017-07-19, 08:04 PM #40Immortal

- Join Date

- Aug 2010

- Posts

- 7,489

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

Season of Discovery - Class Changes Feedback

Season of Discovery - Class Changes Feedback Filter options for non retail wow content

Filter options for non retail wow content MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote