Random tought, what if there was a financial class in school to learn all about money? Maybe that would help!

Crazy idea, i know.

-

2017-12-06, 12:12 AM #61Bloodsail Admiral

- Join Date

- Jun 2011

- Posts

- 1,027

-

2017-12-06, 12:16 AM #62

It really comes down to poor planning. People still feel “young” in their 20s and have no rush to set up a good 401k plan, or IRA if they don’t have that luxury. Hell, a lot go as far as not withholding taxes, or very little, because they feel the money is better used in the “now”, which leads to bad habits and constant “unexpected” debt events. I see it all the time, as I’m 26 and still interact commonly with people 20-30 in the work force.

The thing is though, it’s perfectly do-able. People get themselves in a rut and assume there’s nothing they can do about their situation. I can say, that’s often a problem in the mind. My family, growing up, was quite poor, I graduated college with a 4 year business degree and had a kid to take care of so I had like no experience. However, I’ve had a faithful and healthy relationship (controllable), ambition (controllable), and researched REALISTIC opportunities and took advantage as they came along, and made sure my bills were paid at the very least, and for quite a while lived just to meet my needs. A year and a half after college I make a little more over 50k a year (not bad for Kentucky, we have one of the lower costs of living in the US and cheap housing), “Excellent” credit, will have my first home next year, and a solid direction for growth.

Now, I’m not saying that to brag, because I’m sure to most people here that will sound like nothing. But the point I’m trying to make is that most of the people I’ve come across within each of my groups of friends COULD have done the same thing, most chose not to, with decisions I could explicitly point out, or didn’t have the ambition or drive to actually move around and seek better jobs.

It seems like people don’t start considering careers and retirement a serious conversation until 30+ and you can lose out on hundreds of thousands of dollars worth of growth in a 401k in that time, ruin your credit, and limit your time-frame of tenureship and experience if you wait that long to get serious.

It’s not as hard as people make it out to be. Making good decisions is vastly the difficulty people run into.Last edited by HardlyWaken; 2017-12-06 at 12:52 AM.

-

2017-12-06, 12:20 AM #63

Sounds about right.

Only 31% of millenials contribute to any sort of retirement savings account. That’s rather staggering when you think about it

-

2017-12-06, 12:21 AM #64

-

2017-12-06, 12:24 AM #65Stealthed Defender

- Join Date

- Nov 2014

- Location

- All that moves is easily heard in the void.

- Posts

- 6,798

lol

The vast majority of twenty-somethings throughout history didn't know what they were doing. Millennials are no different than any other group of young adults.

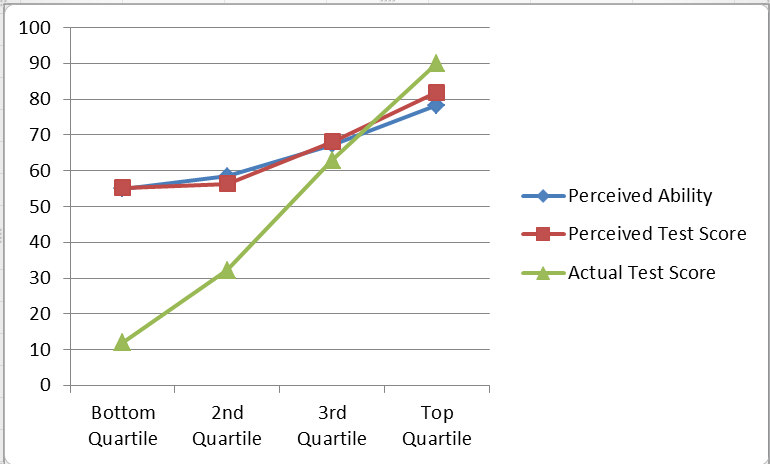

As for giving themselves high marks...of course they did. It's called the Dunning-Kruger effect and it affects absolutely any group you care to name.

Absolutely everyone, no matter how bad they are at something, thinks they are above average, and only the people that are really good at something under-estimate themselves. While John Cleese ends up poking fun at a couple of groups, his description of Dunning-Kruger is a great summary.

-

2017-12-06, 12:25 AM #66

Last edited by Queen of Hamsters; 2017-12-06 at 12:29 AM.

-

2017-12-06, 12:30 AM #67Mechagnome

- Join Date

- Jul 2014

- Posts

- 585

Bah...again with that millennials vs X, i think we have more ppl aware that they need to save and invest to have a better future...and that includes ppl from different generations.

That being said, most ppl love to just spend all they have on stuff they don't need.

-

2017-12-06, 12:31 AM #68

Sometimes, I think everyone's favorite past time involving the millennial label is to blame them for the economy when they're starting to enter the labor market.

Whoever loves let him flourish. / Let him perish who knows not love. / Let him perish twice who forbids love. - Pompeii

-

2017-12-06, 12:39 AM #69

Tbf I have a few Male friends that are atrocious at it. But it was by and large my Female friends. Hell at least 30% of my Male friends already have house and steady finances and we aren't even in our 30's, whereas 0 of my Female friends own houses. Most live with Parents still. Majority don't even own a Car.

-

2017-12-06, 12:40 AM #70

-

2017-12-06, 12:49 AM #71

-

2017-12-06, 12:50 AM #72

-

2017-12-06, 01:03 AM #73

While I don't think having stable finances must necessarily involve "owning" a house, I've got 5 female IRL friends (out of 8) whom got education, worked and purchased a house before the age of 40. The other 3 have stable finances and don't live at home. Cars seem to be the bigger priority among the guys though, many owned a car before they even got an education and a steady job/their own place. Most adults people at home/with a parent that I encounter, tend to be males.

- - - Updated - - -

And it got fucked up, just in time for millennials to come along to "take the blame".Last edited by Queen of Hamsters; 2017-12-06 at 01:06 AM.

-

2017-12-06, 01:09 AM #74

-

2017-12-06, 01:12 AM #75

-

2017-12-06, 01:19 AM #76

I work in debt collection, plenty of people of all ages don't know jack about money and credit.

Human progress isn't measured by industry. It's measured by the value you place on a life.

Just, be kind.

-

2017-12-06, 01:24 AM #77

Must be a truly sad existence to have to resort to finding articles about the fuckups of younger generations for the sole reason of wanting to feel validated and good about yourself

.

"It's time to kick ass and chew bubblegum... and I'm all outta ass."

.

"It's time to kick ass and chew bubblegum... and I'm all outta ass."

I'm a British gay Muslim Pakistani American citizen, ask me how that works! (terribly)

-

2017-12-06, 01:25 AM #78

-

2017-12-06, 01:25 AM #79There are no worse scum in this world than fascists, rebels and political hypocrites.

Donald Trump is only like Hitler because of the fact he's losing this war on all fronts.

Apparently condemning a fascist ideology is the same as being fascist. And who the fuck are you to say I can't be fascist against fascist ideologies?

If merit was the only dividing factor in the human race, then everyone on Earth would be pretty damn equal.

-

2017-12-06, 01:27 AM #80

If being in debt is a sign of being bad with money then hooo boy, an absolute metric fuckton of people young and old are teeeerrible with money. Especially if they ever went to any form of university or had any medical problems without insurance!

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

Best Villain in the History of WoW

Best Villain in the History of WoW MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote