Thread: An insight on Bitcoin

-

2021-06-30, 06:01 PM #721

-

2021-06-30, 06:35 PM #722

-

2021-06-30, 06:41 PM #723

-

2021-07-03, 01:47 PM #724

Pfff this damned up tick.

I should've bought Solana when it was at 23€.

-

2021-07-03, 07:27 PM #725

-

2021-07-06, 02:20 PM #726Keyboard Turner

- Join Date

- Jul 2021

- Posts

- 1

I think that as long as rich people earn on bitcoins, this electronic money will exist. Personally often make money at bet online casino and bitcoins. Although this is more likely an additional income for me than the main one.

-

2021-07-07, 06:34 AM #727

Long term bitcoin short positions since the May crash are starting to bleed out and lose money because bitcoin hasn't been doing shit but range for a long time now. Because of that, people are closing old shorts due to impatience, lack of profitability and disbelief in hitting lower lows and therefore going into small longs, at least until one of the two upper ranges (36k and 41k).

More crabbing for the foreseeable future is pretty much a given, but the important thing to take from all this is the slow loss of interest in breaking the range, upwards or downwards, which is very good for now (especially the lack of determination of the bears so far to break down). A shift in narrative will probably come later this year I believe once the big boys have accumulated, and if that happens, bitcoin will break the range towards the upside again.Last edited by hellhamster; 2021-07-07 at 06:37 AM.

-

2021-07-15, 08:33 PM #728

Bit of a decline going on for the last 2 or 3 days.

On note that's like copy+paste from the antisemitism nonsense, the director of a prominent Portuguese magazine tweeted the following:

https://twitter.com/manjos/status/14...379611650?s=07

First tweet:

The majority of online nay-sayers and anti-vaxxers are also crypto supporters. Draw your own conclusion

Second tweet:

It is an empirical fact. I spent some time browsing the profiles of these nay-sayers and anti-vaxxers. They're a significant part amongst the more vocal. Not every crypto investor is an anti vaxxer, you just have to read

It's with remarks like these that I give myself a pat on the back for not having twitter. I'm split between thinking that the director of a journalistic magazine is willingly committing such dishonesties, and that she's completely oblivious of what a false equivalency is.

-

2021-07-18, 03:15 PM #729Herald of the Titans

- Join Date

- May 2011

- Location

- Sweden

- Posts

- 2,838

Stablecoin is just banks before central banking and will probably work as well.

Haven't read full paper, and they have thoughts and ideas about how to make cryptos actually work in a real market.Last edited by Muzjhath; 2021-07-18 at 04:41 PM.

- Lars

-

2021-07-18, 10:23 PM #730

Crypto is really interesting right now from a social perspective. The market is in the midst of a phase change. Everyone thinks we're in a bear market, or going to the moon next month. Tribalism is at an all-time high, people think their coin will go up forever. The dudebros are going broke, the shitcoins are dying, and regulatory clarity is over the horizon. CBDCs aren't a new concept. Folks following ISO 20022 coins like XRP, XDC, XLM, QNT, ALGO, etc have been paying attention to the CBDC tech race going on globally.

Cryptocurrency was always meant to be the future of finance. All the memecoins, shitcoins, rug pulls, scams, etc will get wiped out. The survivors will be the coins with utility that already exist, and those coins will become the backbone of the new financial system as they will support the "level playing field" that makes CBDCs superior to FIAT in the first place.

It's a trip watching folks of various political leanings weigh in on crypto. I would say most people have no clue what this technology is capable of, unless you've been an enthusiast within the space. Not because you have to be a libertarian or anything like that, but because it's a nascent technology that's essentially a new layer of the internet. The amount of hate it's getting is sadly hilarious, because most people are playing into the billionaires' hands by conflating cryptocurrency, and DLT itself with capitalism.

The wealthy are robbing the common man blind by buying up crypto on discount, while the USD steadily marches towards Weimar-style hyperinflation. If you think cryptocurrency is an inherently fraudulent, hyper-capitalistic, etc then please check out the following videos. This kid is one of the smartest people speaking in the space. He focuses on the technology over the coin-mania, and describes things in a concise and informed manner:

https://www.youtube.com/channel/UCSJ...s7fIka2paR0oYw

-

2021-07-26, 05:45 AM #731

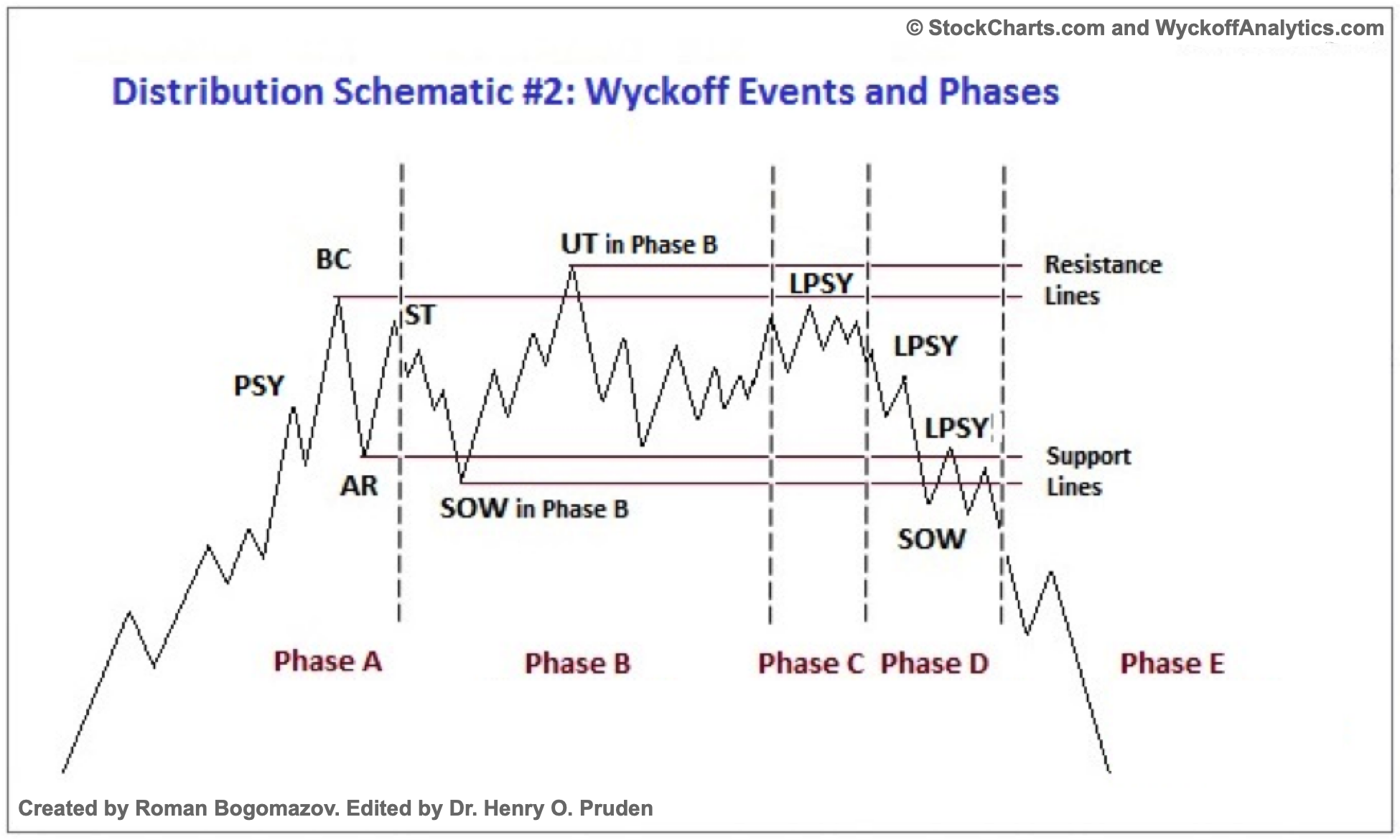

That was a fun pump. Bull run is not resuming per se at 100% certainty, we still need to break and maintain 41.5k for that. I wrote several months ago that we are in a big accumulation range of 30k-40kish, but that latest volume spike, as well as the consecutive green daily candle closes and breakouts are a huge buy signal. Also, rumors of Amazon crypto adoption are rampant, which is even bigger than Tesla.

New range is 36.4k-40k. Bitcoin resuming the bull run within a few months is still very likely as momentum shifts and the narrative changes. Whales were quietly dumping the extreme euphoria and are now pumping the extreme fear. On the short term, we are gonna see some pullback, but the last days indicate a strong upward momentum for the mid term. A strong pullback is healthy to break the upper limits of the accumulation range breakout.

Zoom out and enjoy, we're in for a wild ride.Last edited by hellhamster; 2021-07-26 at 05:48 AM.

-

2021-07-26, 09:50 AM #732

The most annoying about these brief pump moments are all the people - very likely unexperienced ones - whining that they missed the dip. Sigh, if anyone has had money in and has been holding since before the ATH phase, then they're not even near their original investment values after the dip.

-

2021-07-26, 10:08 AM #733

bart mode activated.

700 million in Bitcoin shorts were liquidated. No new tethers to pump i guess.

-

2021-07-26, 11:18 AM #734

Assuming the rumors are true, it was Michael Burry (dude from the Big Short movie) that got liquidated primarily, but it's so far unsubstantiated. Dude hedged for a head and shoulders pattern that was invalidated almost 2 weeks ago. Assuming he was correct, bitcoin was heading to high 4 digits. The lower range (29-30k) held with ease though.

The experienced traders have already loaded up, or are waiting to DCA during another dump at the lower range reaches, which seems kinda unlikely now.

If you follow the big wallets that hold over a thousand BTC, you will notice they have sold at exactly the three peaks during March and April before the Musk dump, and bought back at the big dips of the last couple months.Last edited by hellhamster; 2021-07-26 at 11:23 AM.

-

2021-07-26, 11:32 AM #735

-

2021-07-26, 02:29 PM #736

tether getting criminal probed how exposed is crypto in general? badly?

-

2021-07-26, 03:07 PM #737

Even if Tether proves to be a scam, which is becoming increasingly more difficult right now as time passes and no further evidence is being presented and it's been probed multiple times with no result, traders will just move to the other myriad stablecoins.

Are they backed 1:1? No fiat currency is, and stablecoins are not the exception.

I also think, looking at it objectively, that it's pretty preposterous there is this much scrutiny when it comes to investigating a stablecoin compared to the actual criminals who do 99% of money laundering in the world, the banks.

-

2021-07-26, 04:07 PM #738

-

2021-07-27, 07:09 AM #739

There's an on-chain metric to see accumulation of wallets of a certain size. If more big wallets are created means that the big boys who know what they are doing are actually buying.

That's not even the important thing that the pump triggered. When the price is moving within a range with an obvious resistance level (the high point with strong selling pressure) and an obvious support level (low point with strong buying pressure), nothing usually happens until it breaks out of either side. What happened yesterday was a huge buy wick and a stop loss raid. The futures price movement went up to 48k on Binance, which means over a billion dollar worth of shorts got hunted down and all the bears got destroyed and had to buy back at market price, triggering a cascade in price increase.

Normally I'd agree with @jonnysensible calling the bart. A bart is a pattern that shows a big increase in price followed by an immediate decrease back to the old levels within a day or two, reminiscent of Bart Simpson's head. This is usually what happens when the price is range bound like it has been since May.

However, yesterday's stop loss hunt was that insane that the risk-reward for sellers and shorters multiplied. The increase in price was that big that multiple resistance levels were breached and became support, hence my correct call that the new range would start at 36.5kish and end at 40k. The most logical trade would be a short at 40k and a long at 36.5k. The short liquidation that destroyed tens of thousands of bears yesterday stopped new shorts and provided liquidity for the next leg up, which is bad news for bears who would need to risk a lot to break down the low of the range. Don't get me wrong, nothing is certain and we can still break down to like 33.5, but the risk is higher.

There is some cause for concern that bad news will fuel a price move downwards and I'm kinda expecting it to be honest at this point, but if that doesn't happen, 36k-36.5k remains the bottom for now. Even if it does drop, that is healthy for the mid term for a bunch of indicators to turn bullish.Last edited by hellhamster; 2021-07-27 at 07:44 AM.

-

2021-07-27, 07:58 PM #740

Yeah, nailed it. I've been short term bearish for awhile now, but the bears had multiple opportunities to take this lower, and they didn't. I decided to buy back in Saturday, and I'm so glad I did. We may not be out of the woods yet, but I'm feeling all the more confident after DXY failed to flip resistance into support. BTC started to rise on the 21st, the same day DXY was rejected. It's in a descending triangle now, a crash may happen soon.

- - - Updated - - -

It's not about corruption, it's old money vs new money. The SEC's behavior is emblematic of that.

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

May be stop wasting resoures on experiments?

May be stop wasting resoures on experiments? More permitted video sources

More permitted video sources MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote