Sure that's why I called for position limits. Furthermore their are investors who's interests are PURELY speculative meaning they don't want a god damn thing to do with the actual commodity it's merely a position for them to gain on the inflated value of the commodity. That needs to end like yesterday. It's one thing if a producer of a good wants to hedge his bets against rising commodity prices. It's another if some dick on wall street wants to ride the wave and make money for nothing.

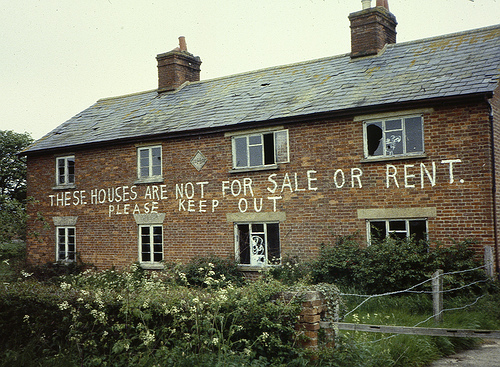

Taxation is one tool to stop people from treating land assets as investment vehicles. Requiring people actually live in that property in that country is another.

- - - Updated - - -

They aren't unfortunately. The rising prices in places like vancouver and toronto are almost all due to foreign investors treating housing as an investment vehcile. It's actually quite amusing to watch condos go up like weeds here. Yet another inevitable housing bubble to pop soon enough.

-

2017-10-06, 08:35 PM #61

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

Has WoW removed the speed limits?

Has WoW removed the speed limits? Are we approaching a Solo Raid WoW Experience?

Are we approaching a Solo Raid WoW Experience? MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote