http://money.cnn.com/2016/04/06/inve...eia/index.html

The U.S. pumped a near-record 9.18 million barrels per day in January.

The driving factor to keep it competitive? Constantly improving efficiency through technology.

The American oil boom is proving far harder to kill than OPEC expected.

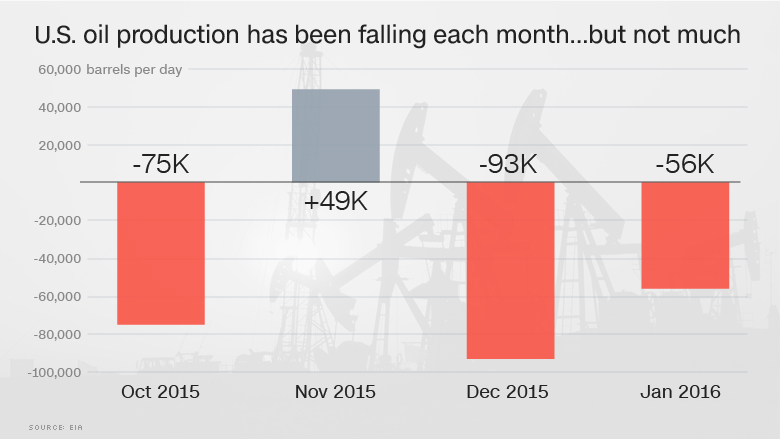

Even though OPEC has been drowning the world in oil, the U.S. pumped a near-record 9.18 million barrels per day in January, according to recent stats released by the U.S. Energy Information Administration.

That's down a miniscule 0.6% from the end of 2015 and is actually slower than the pace of U.S. monthly production declines that started last year.

In other words, America's incredibly resilient oil boom has not tapped on the brakes hard enough yet to fix that epic global supply glut that has caused crude to crash as much as 75% over the past two years.

"The pace of declines have been tortuously slow," said Tom Kloza, global head of energy analysis at the Oil Price Information Service.

Many, including OPEC, expected U.S. production would crumble as oil prices declined sharply. The oil cartel, led by Saudi Arabia, shocked the world in November 2014 by continuing to pump aggressively in the face of oversupply. The thinking was that strong OPEC production would pressure producers in the U.S. and elsewhere that need higher prices to turn a profit.

But that hasn't really been the case. At least not to the degree that would solve the supply glut. Last year, U.S. oil output did start to decline year-over-year for the first time since 2010.

U.S. oil production peaked in April 2015 at 9.69 million barrels per day. Yes, it has come down in the months since then, but only by a modest 5%.

"Oh my gosh, it's been incredibly resilient. It's been a much slower pace of declines than anybody projected," said Matt Smith, director of commodity research at ClipperData, which tracks global shipments.

All of this has thrown cold water on the recent spike in oil prices. Crude is currently sitting at $37 a barrel, up from the 13-year low of $26.05 set in February, but below the recent peak of $41.90.

"People who see light at the end of the tunnel in the second quarter for crude have some incredible vision. They must be using the Hubble telescope," said Kloza.

So why has U.S. production been so resilient? For starters, U.S. shale producers have become dramatically more efficient thanks to technological advancements and price cuts by suppliers.

For example, Texas' Eagle Ford and North Dakota's Bakken both had production declines in January, but oil output actually rose in the Permian Basin in West Texas.

"That is the hot zone, the most fertile shale play. There are guys there making it work," said Kloza.

Another driver: The Gulf of Mexico didn't get the oil crash memo. Production there in January was up another 8% from the year before and the EIA thinks it'll hit a record next year. The Gulf hasn't been responding to the oil crash because deepwater projects require enormous lead times, making them less susceptible to price fluctuations.

Despite the recent resilience, analysts believe U.S. oil output will continue to slowly decline in the coming months as more production comes offline. It's just not clear how much, though.

This situation raises the bar on the highly-anticipated summit in Doha on April 17 between Saudi Arabia, Russia and other global oil producers to discuss a freeze in output.

But will that be enough to fix the global glut, given resilient U.S. output? Capital Economics doesn't think so.

"Freezing output at current high levels would simply maintain the excess supply that is now in place and, as such, would not be a game-changer," Capital Economics wrote in a recent report.

-

2016-04-06, 06:41 PM #1

EIA: The American oil boom is proving far harder to kill than OPEC expected.

-

2016-04-06, 06:49 PM #2

The bigger driving factor is the access to cheap (free) financing. A lot of the financing deals are allowing companies to pay interest only on their debt, which allows companies, having spent the money to build the infrastructure, to make just enough from pumping massive amounts of oil to pay off their interest on their debt without paying the principal. So they basically don't have a choice but to pump as much as possible to keep making the payments in the hopes that the oil price will come back up and they'll be able to pay off the principal, or even better, sell their completed well for enough to pay off the principal.

On top of that, a lot of oil companies have really good hedges, which are only now starting to get renegotiated.

Global production has been falling around 100k per month, as you'd expect, but Iran is coming online now, which will boost global output again, unfortunately. On top of that, oil companies are now sitting on massive stockpiles in excess of 6 months' worth of oil reserves that we'll have to work through before the oil price makes a real proper recovery. We've got another year of this at least unless there's some kind of crisis in an oil producing country.

My company has laid off some 2/3 of our workforce, we just got rid of 3 executives last week, laid off more people this week, and there's a town hall meeting tomorrow.

Last edited by Reeve; 2016-04-06 at 06:52 PM.

'Twas a cutlass swipe or an ounce of lead

Or a yawing hole in a battered head

And the scuppers clogged with rotting red

And there they lay I damn me eyes

All lookouts clapped on Paradise

All souls bound just contrarywise, yo ho ho and a bottle of rum!

-

2016-04-06, 06:52 PM #3The Insane

- Join Date

- Aug 2011

- Posts

- 15,873

I've been seeing articles like this 5 times a day since the oil glut started. Oil should have gone back into the 100 dollar a barrel range about 300 times by now.

It's really just a desperate attempt to convince people to go all in on a hysterical mass speculation push the next time things fluctuate upward.

-

2016-04-06, 06:54 PM #4'Twas a cutlass swipe or an ounce of lead

Or a yawing hole in a battered head

And the scuppers clogged with rotting red

And there they lay I damn me eyes

All lookouts clapped on Paradise

All souls bound just contrarywise, yo ho ho and a bottle of rum!

-

2016-04-06, 06:55 PM #5

-

2016-04-06, 06:57 PM #6'Twas a cutlass swipe or an ounce of lead

Or a yawing hole in a battered head

And the scuppers clogged with rotting red

And there they lay I damn me eyes

All lookouts clapped on Paradise

All souls bound just contrarywise, yo ho ho and a bottle of rum!

-

2016-04-06, 06:58 PM #7The Insane

- Join Date

- Aug 2011

- Posts

- 15,873

-

2016-04-06, 07:00 PM #8

-

2016-04-06, 07:00 PM #9'Twas a cutlass swipe or an ounce of lead

Or a yawing hole in a battered head

And the scuppers clogged with rotting red

And there they lay I damn me eyes

All lookouts clapped on Paradise

All souls bound just contrarywise, yo ho ho and a bottle of rum!

-

2016-04-06, 07:02 PM #10

I'm enjoying the low prices and I'm not looking forward to going back to $3.50+ a gallon again. Better yet fuck oil altogether and I'll hopefully be getting a Tesla Model 3 soon enough.

-

2016-04-06, 07:03 PM #11Legendary!

- Join Date

- Mar 2010

- Posts

- 6,415

it is harder to kill since USA have been way way way to slow to adjust to renewable energy. they should look upon OPEC as a blessing that they want USA out of the oil industry

- - - Updated - - -

prices need to get back to over 4 dollars a gallon to save the environment, We have to levy taxes on gas to make sure it doesnt go below 3.50 ever in todays dollar value

-

2016-04-06, 07:06 PM #12

I mean it sucks for the regions that produce, but for the wider economy it's been something around the lines of a $200 billion economic stimulus.

I know my Winter Oil Heating bill went from $5000 to $1200, on the back of mild winter, a new company, and paying $1.45 / gal for heating fuel rather than $3.50

And the Mobile in the middle of town is insanely still selling gas for $2.95 / gal for regular for anyone stupid enough to go there.

- - - Updated - - -

Cars are the last piece of the renewable energy puzzle. The largest piece is the power grid.

Last year more renewable capacity was installed in the US than any other type and the Coal phase out picked up steam.

-

2016-04-06, 07:20 PM #13

Meh i was hoping prices would remain at 1.65/ gal but they bounced back to 2.00+ on late february

-

2016-04-06, 07:24 PM #14

Don't worry. Unless the Electric Vehicle revolution happens faster than anyone expects, you'll see high prices again. Production naturally falls off by around 100k barrels per day each month. Right now not much new exploration is happening. There's currently still more supply than demand, and Iran will help prop that fact up, but at some point supply will drop below demand. Even then, there will be reserves to work through. Once we've done that, though, there will be a supply shock, since it takes a long time and a lot of exploration to open up new sources of oil. Prices may shoot up significantly in that time period.

'Twas a cutlass swipe or an ounce of lead

Or a yawing hole in a battered head

And the scuppers clogged with rotting red

And there they lay I damn me eyes

All lookouts clapped on Paradise

All souls bound just contrarywise, yo ho ho and a bottle of rum!

-

2016-04-06, 07:31 PM #15

I understand that for producers of oil low prices reduce their revenue and it's bad for them. I'm unsure however why low oil prices would be bad for anyone else. Where I live the price for oil went up yet again despite these apparent low prices for oil (I guess my government just sucks). Considering that oil prices also influence all the prices for food and services and our country is struggling economically, this can't be good.

Can anyone explain why would the average consumer or the average Joe on the street want oil prices to increase?

-

2016-04-06, 07:40 PM #16

-

2016-04-06, 07:47 PM #17Legendary!

- Join Date

- Jun 2014

- Posts

- 6,211

The Fresh Prince of Baudelaire

Banned at least 10 times. Don't give a fuck, going to keep saying what I want how I want to.

Eat meat. Drink water. Do cardio and burpees. The good life.

-

2016-04-06, 07:47 PM #18

Prices dropped where I am.

Still lovin' the cheap gas.

I know it won't last.

-

2016-04-06, 07:49 PM #19

Wouldn't higher prices for oil while waiting for alternative renewable sources simply be a penalty for those that are reliant on oil without alternatives? I am not quite convinced that we are anywhere near seeing a viable replacement for oil in the near future, and if we are it would take a small while at the least to spread widely. I'm yet to see an electric car and these are apparently becoming more prevalent in some places. While stuck using oil, higher prices only make you suffer.

This one I could understand. A moderate price hike now to prevent a huge hike in the future. But then again, why would you want either if you can avoid them both?Moderately higher prices in the short term leading to continual exploration/development of resources that prevent a massive spike in prices later.

I'm quite confused behind the rationale of it all. /shrug

Thanks for attempting to broaden my understanding.

- - - Updated - - -

Yeah, where I live the prices don't go down when the oil does. At least not appreciably if it does indeed. But they sure do go up every time oil prices increase though, with a minor delay of course.

-

2016-04-06, 07:58 PM #20High Overlord

- Join Date

- Mar 2013

- Posts

- 161

But we have the alternatives already. We simply view the opportunity cost of switching to a renewable resource (as consumers) as too high compared to current oil prices. If they were to raise however, consumers will funnel increase funds into innovation for renewables.

And you cannot avoid both because firms will always want to maximize profits and minimize loss. Therefore, most firms are shutting down or reducing production now to cut losses. But the demand will still remain relatively the same when the total oil in market drops as a result. So higher prices are inevitable.

From the point of view of a consumer such low prices are bad for cities with least diversified economies (see Alberta) and pockets of these recessions across the country slows growth and brings down the total GDP.

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

Seasonal Poll: What Playable Race would u like to have in World Soul saga?

Seasonal Poll: What Playable Race would u like to have in World Soul saga? MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote