https://ftalphaville.ft.com/2017/02/...euro-long-ago/

https://www.theguardian.com/business...s-unexpectedlyIf any country in the world could have benefited from looser monetary policy in the past seven years, surely it would have been Greece, which suffered (and still suffers) from achingly high capital costs, sky-high debts, and depressed asset values.

Unfortunately for Greeks, however, the institutions of the euro area were designed to prevent anything comparable to America’s 1933 reflation. The single currency’s founders were more concerned with limiting the “competitive devaluations” of the 1970s and 1980s, which seems quaint now.

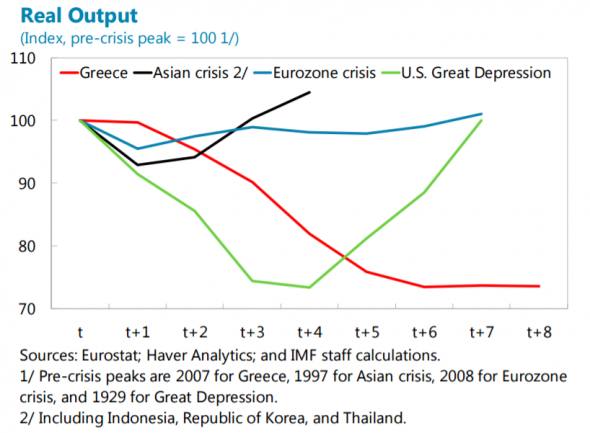

The IMF’s provocative comparison therefore suggests the Greek government’s best option, albeit one that didn’t look particularly appealing at the time, would have been to restore monetary sovereignty and inflate its way out of its debts as soon as things started looking bad, perhaps in 2010 or 2011.

Combine the loosening of domestic financial conditions with a favourable move in the exchange rate and you might have ended up with a situation comparable to Argentina in the early 2000s — a bad deal compared to Greece’s history of convergence in the 1990s but much better than what actually happened.

The interesting question is if the logic still holds today. On the one hand, the economy has stopped shrinking. But it also hasn’t been growing, and there don’t appear to be any policy changes on the horizon that might meaningfully tackle the massive shortfall in Greek domestic spending and unemployment. The IMF would never suggest Greece leave now, given the preponderance of European votes on the board of directors, but its latest analysis hints at some interesting ideas.

10 years of poverty and misery later. Will the ECB change it's stance on pointless interest payments or are the German creditors not satiated with enough blood yet?The standoff between Greece and its creditors has escalated, with the embattled Athens government vowing it will not give in to demands for further cuts as data showed the country’s economy unexpectedly contracting.

As thousands of protesting farmers rallied in Athens over spiralling costs and unpopular reforms, the Hellenic statistical authority revealed that Greek GDP shrank by 0.4% in the last three months of 2016.

After growth of 0.9% in the previous three-month period the fall was steep and unforeseen. On Monday the European commission announced that the eurozone’s weakest member was on course to achieving a surplus on its budget of 2.3% after exceeding its 2016 fiscal targets “significantly”.

The setback came as prime minister Alexis Tsipras’ lefist-led coalition said it would not consent to additional austerity beyond the cuts the country had already agreed to administer under its third, EU-led bailout programme.

Speaking on state TV, the digital policy minister Nikos Pappas, Tsipras’ closest confidant, insisted that ongoing differences between the EU and International Monetary Fund over how to put the debt-stricken state back on the road to recovery were squarely to blame for the failure to conclude a compliance review at the heart of the standoff. The IMF has argued vigorously that extra measures worth 2% of GDP will have to be enforced with immediate effect if Greece is to achieve a high post-programme primary surplus of more than 1.5%.

“The negotiations should have ended. Greece has done everything that it was asked to do,” he said and added there would be “no more measures”.

The future of the €86bn financial aid programme is contingent on Athens implementing agreed economic reforms. The IMF has repeatedly said it will not sign up to the programme unless the crisis-plagued country is given more generous debt relief in the form of a substantial write-down.

With Greece facing a €7bn debt repayment to the European Central Bank in July, fears of a Greek default have once again hit markets with shares falling and interest rates on Greek debt rising.

But Tsipras is also under pressure from back-benchers in his fragile two-party administration. After seven years of adopting grueling austerity in return for emergency bailout aid many are openly questioning the wisdom of applying yet more measures that have already put Greece in a permanent debt deflationary cycle.

All eyes are now on a flying visit Europe’s economics chief Pierre Moscovici will make to Athens on Wednesday. Government sources said they were hoping the EU commissioner would come with an “honourable compromise” acceptable to all so that stalled negotiations could resume with the return of auditors as soon as possible.

But the eurozone chief, Dutch finance minister Jeroen Dijsselbloem, warned it was unlikely a solution would be found before the next meeting of finance ministers representing countries in the currency bloc on 20 February – raising the spectre that Greece could be headed for a rerun of 2015 when it teetered towards euro exit.

On Monday, Christine Lagarde, the IMF’s managing director, raised the stakes further saying Greece could not be singled out for special treatment. “We have been asked to help, but can only help at terms and conditions that are even-handed,” she told Reuters. “In other words we cannot cut a special sweet deal for a particular country because it is that county.”

Despite the delay, Greek officials have repeatedly voiced optimism that the review will soon be concluded. Amidst the uncertainty the real economy has been put on hold with non-performing bank loans and private debt ballooning. This week the head of the Greek public power corporation, DEH, said lack of liquidity was such that the body was on the verge of bankruptcy.

-

2017-02-20, 02:21 PM #1

Greece economic woes worsen as IMF says greece should have left Eurozone

-

2017-02-20, 02:22 PM #2

Maybe the government of Greece should have been more responsible with how they ran their country.

-

2017-02-20, 02:24 PM #3

-

2017-02-20, 02:26 PM #4

Greece ran itself into the ground all on its own. They were pushing an unsustainable welfare state, and it finally came crashing down. They can blame Germany and the EU all they want, but those were just bad attempts to save a failed state. If I were Germany, I would have never intervened. Let Greece fail, let their people figure it out for themselves.

-

2017-02-20, 02:27 PM #5

-

2017-02-20, 02:28 PM #6

-

2017-02-20, 02:28 PM #7

-

2017-02-20, 02:29 PM #8Legendary!

- Join Date

- Jun 2011

- Posts

- 6,028

They didn't let them exit in 2008 because the whole EU project would have come crushing down. They pushed reforms that didn't make sense what so ever and even today that IMF says that debt is unsustainable and that by 2030-40 will have skyrocket, no one listens to them.

-

2017-02-20, 02:29 PM #9

-

2017-02-20, 02:33 PM #10

-

2017-02-20, 02:34 PM #11

-

2017-02-20, 02:34 PM #12

One of the weirdest parts of the financial crisis and ensuing fallout for me was seeing this prevailing trend of people and countries that took loans that they couldn't pay back became the victims in the eyes of many. This, to me, runs almost exactly counter to reality - people and countries that take loans that they can't pay back aren't the victims, they're the villains.

-

2017-02-20, 02:34 PM #13

-

2017-02-20, 02:35 PM #14

-

2017-02-20, 02:36 PM #15

Germany force austerity on a sovereign nation? Or did the people vote for austerity? What's more, the path Greece was on was going to lead to a complete collapse. It was the epitome of a welfare nation, and was crumbling. People can get pissed at Germany, but if it weren't for Germany, then Greece would have disappeared off the map.

-

2017-02-20, 02:38 PM #16Legendary!

- Join Date

- Jun 2011

- Posts

- 6,028

-

2017-02-20, 02:38 PM #17

-

2017-02-20, 02:39 PM #18Legendary!

- Join Date

- Jun 2011

- Posts

- 6,028

-

2017-02-20, 02:40 PM #19

-

2017-02-20, 02:40 PM #20Elemental Lord

- Join Date

- Mar 2009

- Location

- Wales, UK

- Posts

- 8,527

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

Blizzard must stop introducing neutral races immediately

Blizzard must stop introducing neutral races immediately Did Blizzard just hotfix an ilvl requirement onto Awakened LFR?

Did Blizzard just hotfix an ilvl requirement onto Awakened LFR? Premades Epic Battleground

Premades Epic Battleground MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote