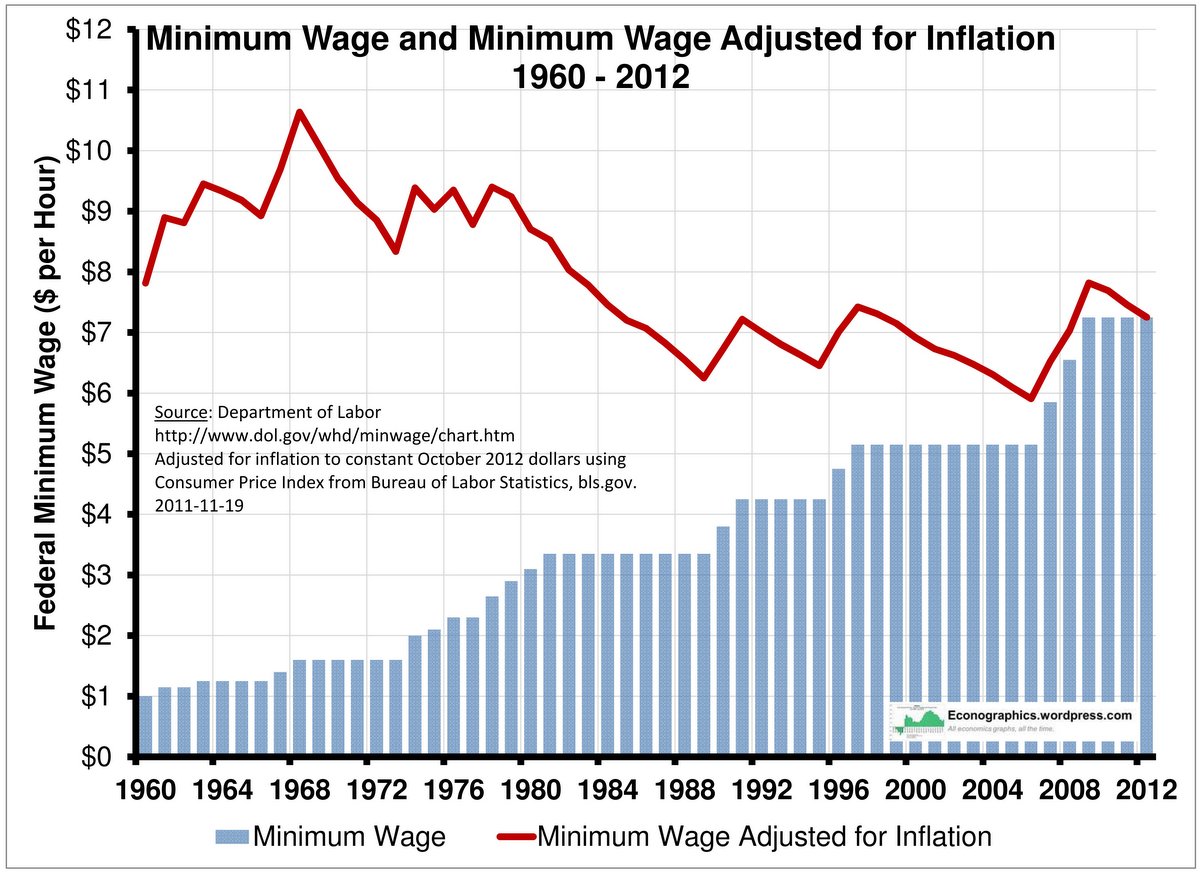

The economy is strong it has been strong under Obama years before Trump, again the problem is wage growth, income inequality and lack of upward mobility. The rich and corporations have seen major recovery with the stock market the majority of Americans do not feel it. Are you this much disconnected from reality or is it just plain denial? here are some nice charts since you seem to be having areal hard time with this.

Thread: Republican Tax Plan Revealed

-

2018-01-04, 02:49 AM #1741

-

2018-01-04, 02:52 AM #1742Legendary!

- Join Date

- Jul 2010

- Posts

- 6,767

The logic of tax cuts creating jobs still doesn't make sense to me. Companies and wealthy individuals at the top already have a tremendous amount of money. They have more wealth than could reasonably be spent in a lifetime outside of buying islands and space ships. If they wanted to just go on a job creating spree or give current workers huge raises they could already do that and still have plenty of money left over.

As for small business... It seems like their hiring practices are still directly tied to demand. People will have a few extra bucks to spend (maybe), but that isn't enough to make millions of a jobs appear out of nowhere.

-

2018-01-04, 02:59 AM #1743

The economy has been improving for the last 7 years now, and is now back up to pre-recession numbers. This also wasn't something that happened the instant Trump came into office, we did not suddenly go from recession and flat lining under Obama to suddenly better than pre-recession numbers, it's been a trend line since two years into the Obama administration. And as has been pointed in numerous threads, the hiring boosts when Trump came into office weren't even unprecedented. Trump liked to brag about how the jobs created under his administration are the best they've been since George W, but that is an objective lie, since Obama had even better months.

So the economy is up, less people are unemployed, which means that more people have more money to spend, which means that more money is being spent, and thus more jobs created as a result of that money spent. But here's the funny thing: These tax cuts haven't even gone into effect yet and everyone is bragging about how lowered taxes create more jobs. Really now. You don't say. Lowered taxes that don't even take effect yet have been creating jobs all year?

Tell me more.2014 Gamergate: "If you want games without hyper sexualized female characters and representation, then learn to code!"

2023: "What's with all these massively successful games with ugly (realistic) women? How could this have happened?!"

-

2018-01-04, 05:43 AM #1744

-

2018-01-04, 07:46 AM #1745I am Murloc!

- Join Date

- Jun 2012

- Location

- Bordeaux, France

- Posts

- 5,923

Exactly man. If you want to restart the economy, you need to rise the purchasing power of the general public. With more money, people will consume more, go to restaurant, buy newer cars or furniture, jewels or electronics, whatever they enjoy but can't afford now.

Which in turn will create a demand for those products and service, and company will be happy to meet the demand, more money for them.

But giving massive tax cuts to the company will not results in more jobs, the only reason a company will hire is if their current workforce can't handle the demand.

-

2018-01-04, 01:17 PM #1746

-

2018-01-04, 01:30 PM #1747

https://www.statista.com/statistics/...gdp-in-the-us/

Your impressions are not based in reality.

-

2018-01-04, 01:40 PM #1748

-

2018-01-04, 01:42 PM #1749

-

2018-01-04, 02:17 PM #1750

-

2018-01-04, 03:59 PM #1751

OMG the nasty Tax cutts are the Apocalypse . run, hide. the end is near...

the same those evil companys.. Even More US Businesses Awarding Bonuses, Raising Wages, Expanding Due to Tax Reform

Effective in 2018, Aflac makes the following commitment to our U.S. workforce:

1. Increase the company’s 401(k) match, from 50% to 100% on the first 4% of employee contribution, while making a one-time contribution of $500 to every employee’s 401(k) plan. 2. Offer certain hospital and accident insurance products to all employees free of charge, as the company currently does with its core cancer insurance product. Aflac expects to increase overall investment in the U.S. by approximately $250 million over three to five years...“We are pleased that these tax reforms provide Aflac with an opportunity to increase our investments in initiatives that reflect our company values; providing for our employees in the long and short term, ensuring future growth for our company and giving back to the community,” Aflac Chairman and CEO Dan Amos said. “We will use these funds to help secure healthy retirements, develop employee skills in an evolving global business climate, and provide additional protections for our workers and their families. At the same time, we will strategically invest in growing our business, while increasing our commitment to children and families facing childhood cancer.”Bonuses for thousands of Total System Services employees in Georgia:

Total System Services Inc. (NYSE: TSS) is crediting tax reform for cash bonuses going to their team members worldwide. A spokesperson for the Columbus, Ga.-based credit card processor best known as TSYS told Atlanta Business Chronicle that it made an internal announcement Tuesday that team members would receive a "special one-time cash bonus of $1,000" as "a result of the company’s continued success and the recently passed U.S. tax reform legislation." TSYS, which is celebrating its 35th anniversary in 2018, has about 11,500 employees -- a little more than 5,000 of whom are based in Georgia.Bonuses for manufacturing employees in Oklahoma and Texas:

Workers at Tulsa-based AAON will celebrate the new year with some extra cash. AAON announced Tuesday that people employed by AAON on Jan. 1, 2018, excluding officers, will receive a $1,000 bonus in recognition of the new tax reform law. AAON, which manufactures industrial and commercial HVAC equipment, employs about 2,000 at facilities in Tulsa and Longview, Texas. "We are very appreciative of all AAON employees and want to commemorate the passing of this historic, economy-stimulating tax reform law," AAON CEO Norman H. Asbjornson said in a statement.Extra cash for supermarket workers in Delaware, whose employer also says the business is in a stronger position to grow:

Delaware Supermarkets Inc. is handing out $150 bonuses to 1,000 non-management and union-represented employees as a result of the recent tax reform bill being signed into law. The bonus is in addition to holiday and performance bonuses. The Wilmington, Delaware-based company, which owns six ShopRite supermarkets in New Castle County, Delaware, will also invest $150,000 into employee training and development programs. The company, locally known as Kenny Family ShopRites, is following in the footsteps of such large corporations as AT&T, Boeing and Comcast. “Our ability to provide bonuses and training to our employees demonstrates the far-reaching implications of this tax reform,” said Christopher Kenny, president and CEO of Delaware Supermarkets. “We have a renewed optimism for the local and the national economy, and this important legislation better positions us for future growth.”Pay raises and doubling the workforce across multiple states at Nexus Services:

All Nexus Services, Inc. employees will receive a 5% raise, starting in January 2018, CEO Mike Donovan announced today. Also, Nexus unveiled plans to hire another 200 workers over the course of 2018 – doubling the size of Nexus Services, Inc. workforce nationwide. Many of the new jobs will be created in Virginia’s Shenandoah Valley and other jobs will be in San Juan (Puerto Rico), Hackensack (NJ), Ontario (CA) and other sites nationwide...The 5% boost in pay will come on top of the increased take home pay that workers will enjoy due to lower Federal income tax rates for individuals. The more than 200 new jobs Nexus plans to create over the next 12 months will each have a “living wage” and provide full benefits including, health, dental, vision, and retirement plans. A combination of an improved business outlook for 2018 and tax reform by Congress has enabled Nexus Services, Inc. to make these generous changes.Bonuses and increased wages for non-executives across the more of the banking sector:

-Minneapolis-based U.S. Bancorp today announced a $1,000 bonus for nearly 60,000 employees, a new minimum wage of $15 per hour for all hourly employees and a $150 million contribution to the U.S. Bank Foundation. The company also said it would enhance employee health insurance offerings and pour more money into improving customers’ mobile and digital experiences.

-Dallas-based Comerica also provided a $1,000 bonus for its non-officer employees and boosted its bank-wide minimum wage to $15.

-First Financial Northwest, headquartered in Renton, Wash., said it would pay a $1,000 bonus to all of its non-executive employees.

-Bank of the James, Lynchburg, Va., raised its minimum wage to $15 per hour for employees with more than one year of service, added vacation days and substantially increased its charitable giving plans for 2018.

-First Farmers Bank and Trust in Converse, Ind., said that it would raise its minimum hourly wage by $2.50, provide a 2017 year-end bonus of $750 for all full-time employees, invest at least $250,000 annually in community development activities and spend at least $150,000 per year on employee professional development.the law will also reduce taxes for 80 percent of all US taxpayers, including 91 percent of the middle class. If any of this surprises you, you've been taken in by the Left's hyperbolic propaganda machine, which was operating in overdrive in a failed effort to kill the bill.A few more examples.. here https://www.marketwatch.com/story/zi...od/accounts-mw

-

2018-01-04, 04:01 PM #1752It is by caffeine alone I set my mind in motion. It is by the beans of Java that thoughts acquire speed, the hands acquire shakes, the shakes become a warning.

-Kujako-

-

2018-01-04, 04:06 PM #1753

-

2018-01-04, 04:09 PM #1754

They'll just respond with how they've not read the bill because it's boring, but they somehow know they'll save more than any tax bracket is set to be reduced by. Not much you can do, but it is a good example of how despite everything the Republicans will probably do fine in 2018 (when coupled with gerrymandering).

It is by caffeine alone I set my mind in motion. It is by the beans of Java that thoughts acquire speed, the hands acquire shakes, the shakes become a warning.

-Kujako-

-

2018-01-04, 04:18 PM #1755

I'd add a lot of stuff too if I knew Trump was going to do everything he could to benefit them. It's almost like they know the man will do anything and everything to benefit them, even if it comes to the detriment of most of the population.

I don't have time to go into why most of what you said was wrong, but you should look into the dozens upon dozens businesses that won't be increasing work force or increasing wages. Your six examples doesn't put a dent into the hundreds that show the opposite.

-

2018-01-04, 04:21 PM #1756

-

2018-01-04, 04:23 PM #1757

-

2018-01-04, 05:02 PM #1758

So here is how it goes:

Either my wife and I both work, both pay income taxes, and we send our kids to daycare, which is subsidized by the child care tax credit (which is for everyone btw, the amount of the return is income based, but even millionaires get 20% of allowable expenses as a refundable credit).

Or

I work, my wife stays home with our kids, we go on Medicaid and SNAP, and I pay effectively zero income taxes, because our household AGI would be under $20k with just my salary, after the standard deduction, and we would still get the child tax credit and a couple others.

Which do you think is a net gain for the country overall?

BTW, for those without children who are unfamiliar with the details:

The Child Care Tax Credit allows a percentage of childcare expenses to be counted as a credit towards your tax liability. Up to $6000 in expenses are allowable (expenses above $6000 are irrelevant for purposes of this credit). You will receive a credit for somewhere between 20% and 35% of your allowable expenses, depending on your income. Up to $1400 of this credit is refundable.

-

2018-01-04, 05:40 PM #1759

How does me paying for his child care a benefit to anyone other than him

- - - Updated - - -

Or you could have some personal responsibility and work 2 jobs while your wife stays home and takes care of the kids like my father did. You should be doing what you must to survive instead of forcing others to subsidize your life. Once the kids are in school, then you and your wife can each work one job. You would only have to work 2 jobs for a few years

-

2018-01-04, 05:43 PM #1760

Yeah guys, how would helping others kids every benefit Orlong? I mean I can't ever think of a time where the schools he pays for with his taxes have ever benefited him at all. Oh, and paying for those roads and sidewalks the kids walk on, fuck those now, I shouldn't be paying for the ability for others to drive and walk paces.

- - - Updated - - -

So you work two jobs while your wife stays home?

Recent Blue Posts

Recent Blue Posts

Recent Forum Posts

Recent Forum Posts

What game first sparked your interest in gaming? Was it World of Warcraft?

What game first sparked your interest in gaming? Was it World of Warcraft? Hide "earned by" on Achievements

Hide "earned by" on Achievements Did Blizzard just hotfix an ilvl requirement onto Awakened LFR?

Did Blizzard just hotfix an ilvl requirement onto Awakened LFR? MMO-Champion

MMO-Champion

Reply With Quote

Reply With Quote